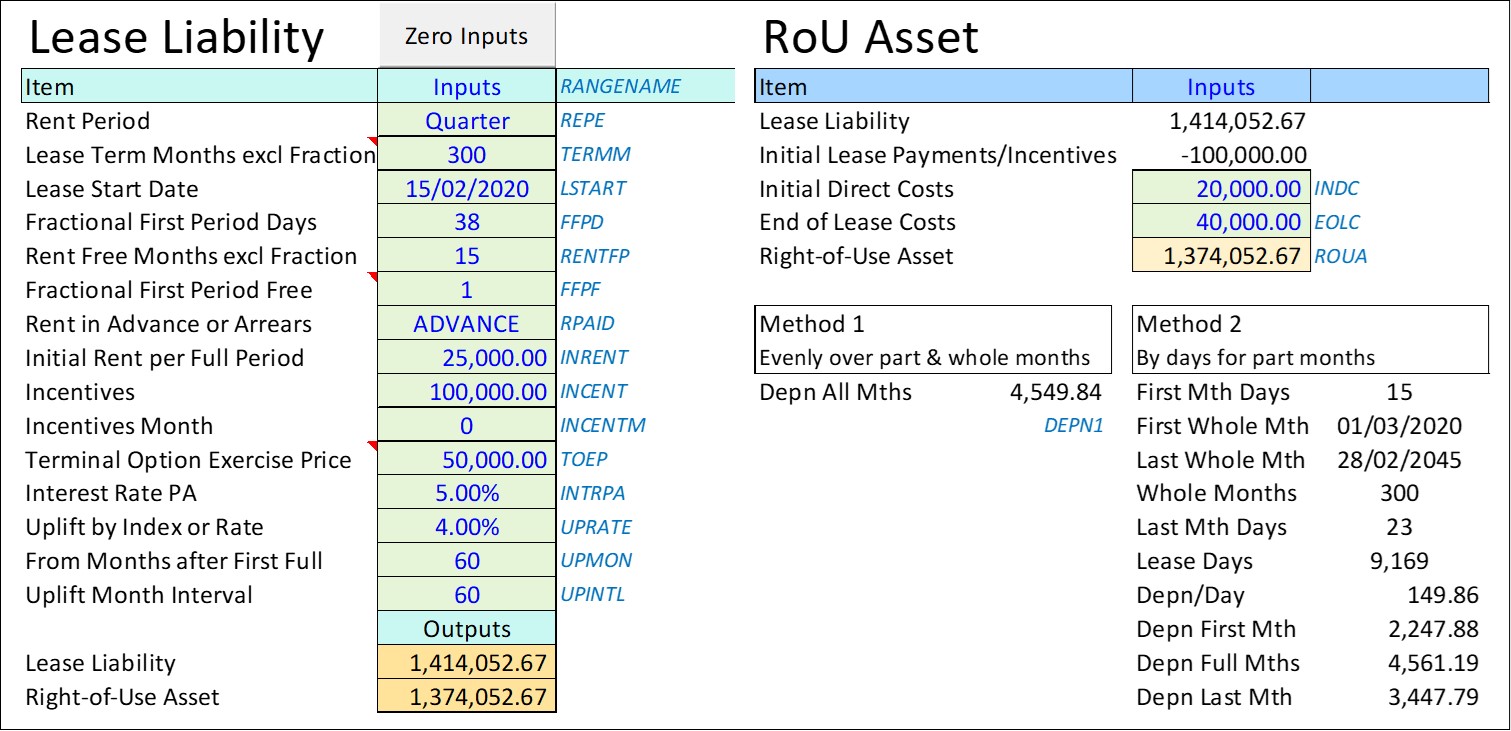

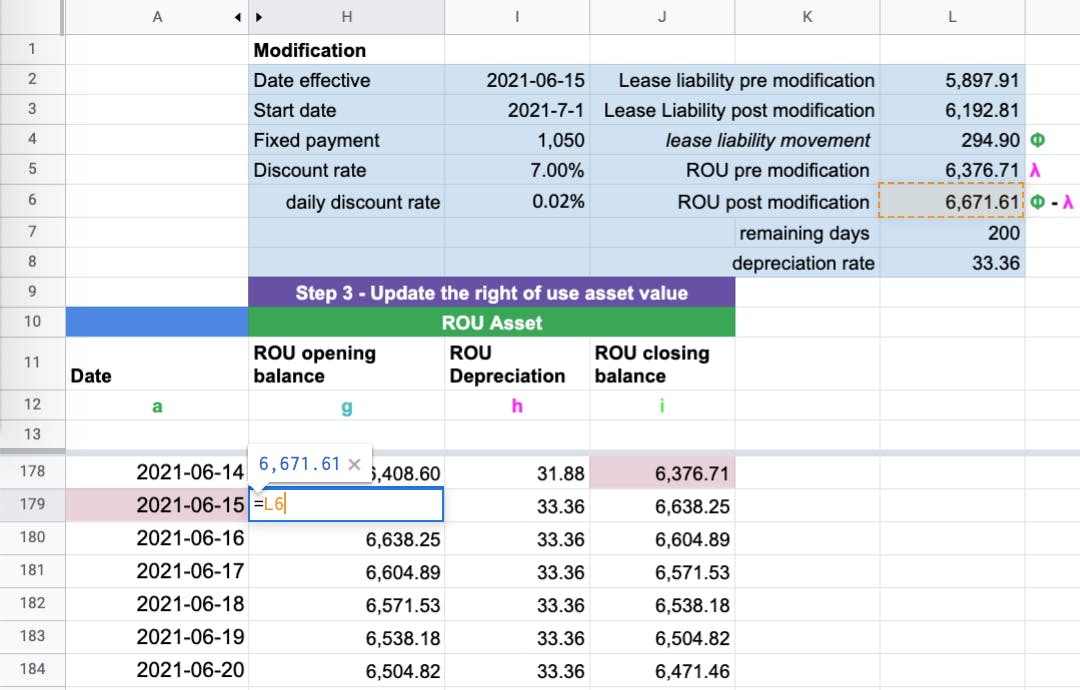

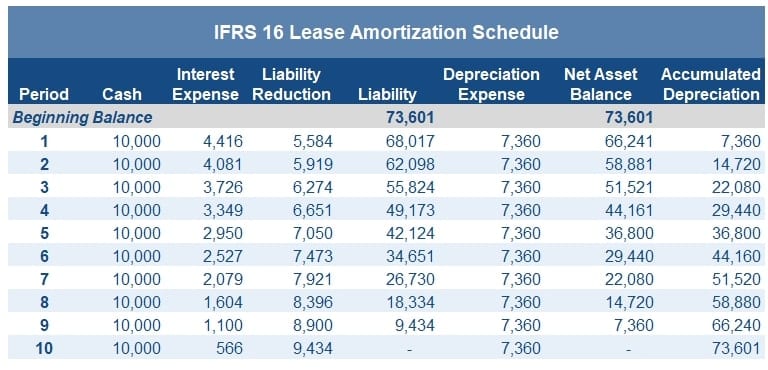

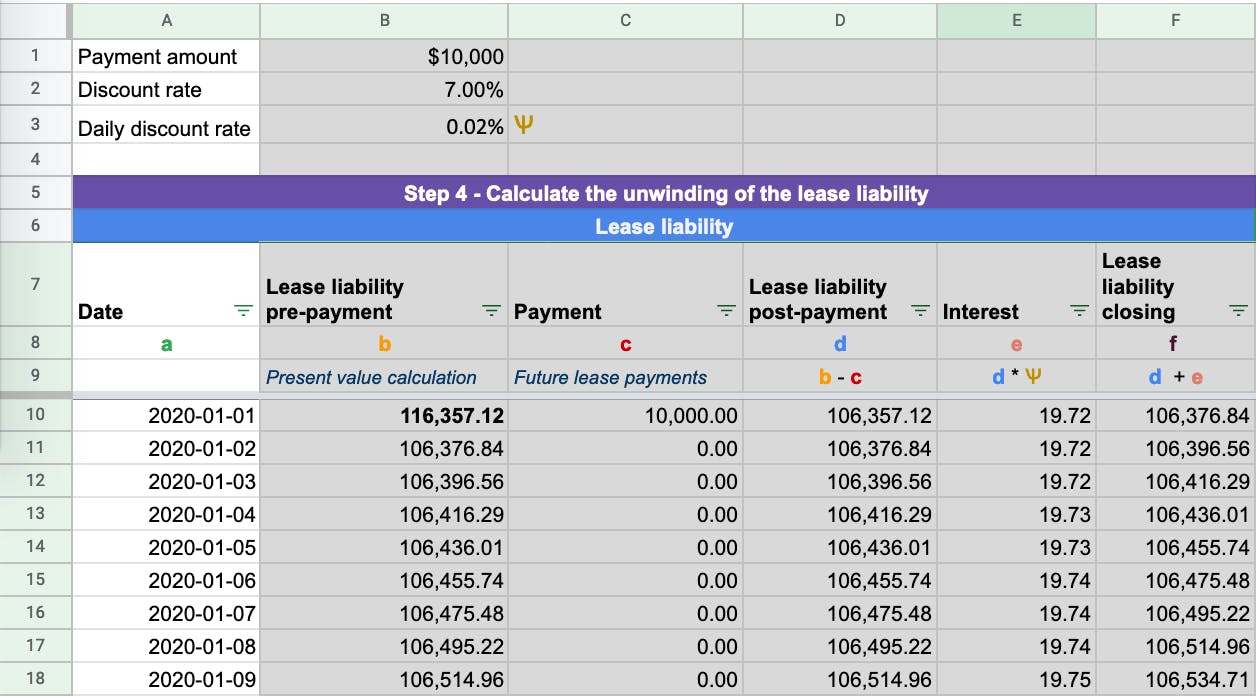

How to Calculate the Lease Liability and Right-of-Use (ROU) Asset for an Operating Lease under ASC 842

How to Calculate the Lease Liability and Right-of-Use (ROU) Asset for an Operating Lease under ASC 842

How to Calculate the Lease Liability and Right-of-Use (ROU) Asset for an Operating Lease under ASC 842